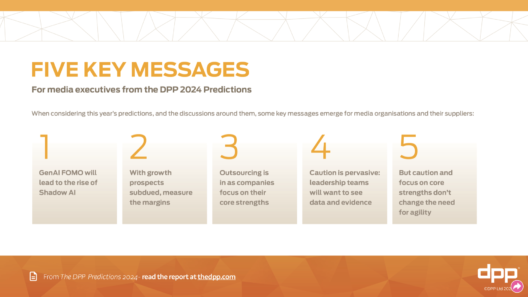

The DPP has published its assessment of how well vendors at IBC 2023 met the current needs of their customers. IBC 2023: Demand vs Supply looks at four key areas in which the customer community has stated it has an interest, and assigns a score to how well the market is responding to those demands. The DPP’s scores separate the technology that’s hype from the technology that helps - and this year reveals significant synergy between the thinking of customers and their suppliers.

There is significant alignment between the thinking of customers and suppliers

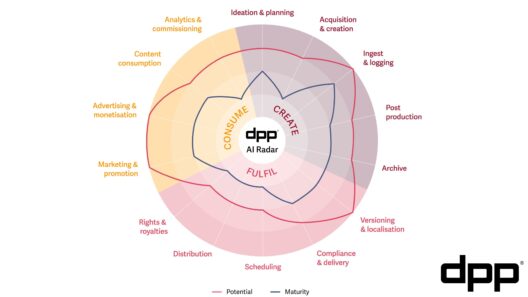

In determining the focus for its assessment of IBC 2023, the DPP identified four areas that have been much discussed by media organisations in DPP workshops and conferences throughout the year:

Optimising Streaming

Generative AI

Modular asset management

Simplifying automation

Further research was then conducted with 21 major content providers to identify their key needs and concerns in these areas. Simultaneously, the DPP surveyed its membership to identify exhibiting suppliers seeking to provide relevant solutions. This led to DPP Technology Strategist David Thompson researching the offers of 60 vendors.

“What was particularly interesting,” says Thompson, “was the amount of common ground between customers and their suppliers. For example, there was an overarching demand from customers for simplicity. Suppliers fully understand that it’s actually very complex to provide solutions that feel simple for users, and requires significant ecosystem collaboration. But many are embracing the challenge.”

It is very complex to provide solutions that feel simple for users

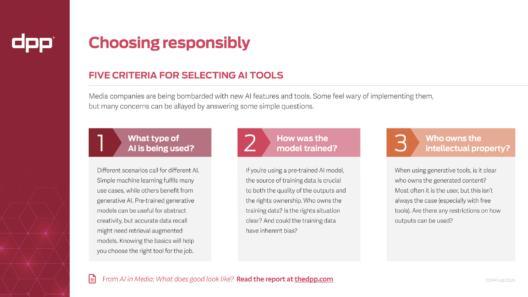

Going into IBC, the biggest talking point was Generative AI. Media organisations are curious about its potential while careful about its legal and ethical risks. Thompson was pleasantly surprised by the number of applications of Generative AI to address real world customer needs.

But ultimately constraints around provenance, legality, and the expense of human moderation limited this area to a score of two out of five for maturity of supply.

The area with the most striking match between demand and supply was modular asset management. The shift way from monolithic MAM solutions is relatively recent - and is as much a response to new supplier solutions, as a driver for them. It also aligns with thinking in other demand areas

This area scored an impressive 4 out of 5 in the DPP assessment.

“While the connection between Modular Asset Management and Simplifying Automation is obvious - more modularity requires more automation - it is also interesting to note that both these areas overlap with Optimising Streaming,” says Thompson. “ Reducing the cost of streaming means simplifying the OTT distribution chain and making it easier to manage and support with fewer resources.”

Customers and suppliers are working together to provide the right interfaces and capabilities to users

These developments reflect a growing need among content providers to pass workflow design, management, and delivery into the hands of more operational - and less technical - teams. And that in itself is deepening relationships between customers and their key suppliers as they work together to provide the right kinds of interfaces and capabilities to end users.

The IBC 2023: Demand vs Supply report is available to DPP members for download here.

Thirty five major media organisations will be sharing their technology and operations priorities for 2024 at the DPP Leaders’ Briefing conference in London, 8-9 November 2023.